This information is being shared by the SSA and is pending publication of the finalized IRS regulations. In 2023 that limit is lowered to 10 W-2 forms, meaning that this rule will soon apply to the majority of employers. If your company is in this boat, you may need to start looking at electronic options.īeginning in 2022, if you send out 100 or more W-2 forms, you are required to send them electronically. Many employers are still sending out paper versions of the W-2 form by mail. HR departments see a spike in such requests in early April before Tax Day. If you deferred payroll tax for your employees in 2020, and if you collected this tax in 2021, then you need to send in a W-2c to correct Tax Year 2020 Social Security taxes. This deferral applied to employees who earned less than $4,000 per bi-weekly pay period (or the equivalent threshold amount with respect to other pay periods) on a pay period-by-pay period basis. In response to the coronavirus pandemic, the Treasury and IRS provided employers with the option to defer the employee portion of Social Security tax from Septemthrough December 31, 2020. Current or past employees may request a last-minute copy, so be sure to retain a copy that you can mail or transmit electronically. By this date, you should have sent out all W-2s, but do keep this date in mind if you mailed paper forms, as there are bound to be some last-minute tax filers who have misplaced their copy or forgot to give you their change of address information. Independent contractor pay was previously reported on a 1099-MISC form prior to the 2020 tax year.Īp– Tax Day for Individuals. You must send Copy A of the 1099-NEC form to the IRS and send a copy to the payee as well. Janu– If you utilize independent contractors, you need to send form 1099-NEC to any contractors that you paid over $600 in the 2021 tax year. Janu– Wage reports for the 2021 tax year must be filed with the Social Security Administration. Janu– Deadline to mail or distribute W-2s to employees. Employers are also responsible for filing a FUTA return annually, and depositing those taxes.

#DATE FOR W2 MAILINGS FULL#

Employers must report income and employment taxes withheld from their employees on an Employer’s Quarterly Federal Tax Return (Form 941) and deposit these taxes in full to an authorized bank or financial institution pursuant to Federal Tax Deposit Requirements. Income tax would have been withheld if the employee had claimed no more than one withholding allowance or had not claimed exemption from withholding on a Form W-4, (Employee’s Withholding Allowance Certificate).Įmployers also need to report and deposit payroll taxes to the internal revenue service (IRS) every quarter. Income, Social Security, or Medicare taxes were withheld

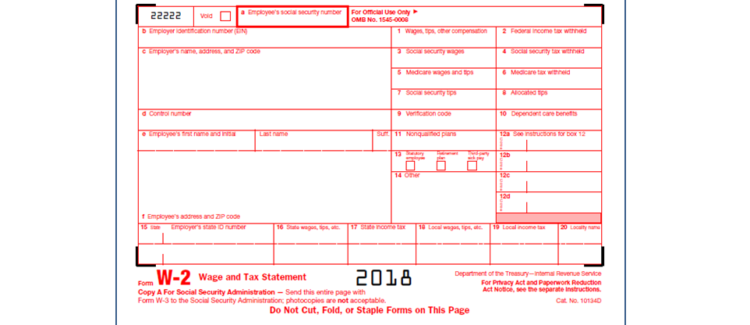

Employers also have to send a copy of the W-2 to the employee.Įmployers are required to file a Form W-2 for wages paid to each employee from whom: Reporting requirementsĪt the beginning of each year, employers have to send Copy A of Form W-2 to the Social Security Administration (SSA) to report the wages paid and taxes collected for your employees during the previous calendar year. Here is what you need to know to stay on top of your W-2 compliance for tax year 2021. W-2 compliance is extra important this year, as there are a couple of changes. These are the tax forms that your employees need to file their yearly tax returns. However, with frequent changes, shifting deadlines, and more, keeping compliant can feel like a daunting task.įorm W-2 is the Wage and Tax Statement that employers use to report wages paid to employees.

For businesses and employers, that means end-of-year accounting and W-2 filing is right around the corner.

0 kommentar(er)

0 kommentar(er)